PECULIUM

Peculium! What is.

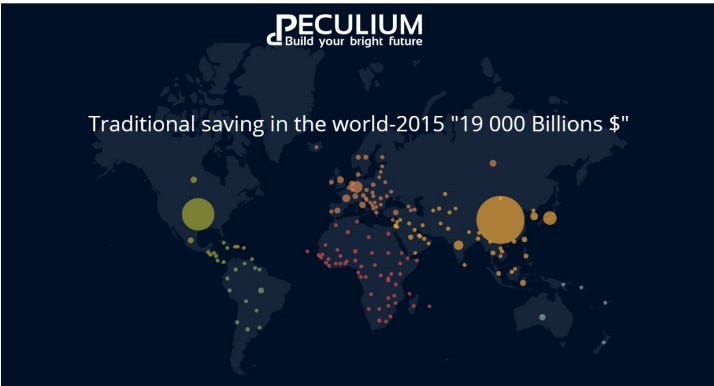

The main source that determines the essence of the investment are savings. They are involved in order to be effectively used in the real sector of the country’s economy. The economy needs a redistribution of money from those who have it, and who needs it. These funds save the population, but they need the state and entrepreneurs. The main factor of economic growth is investment. During the investment period, aggregate demand is increased, and in the future — the aggregate supply is increased. Investments can be called those savings, which ultimately bring profit. This happens by investing them in various activities.

The state and financial communities are searching for sources of financing to meet investment needs. To reproduction and renewal of fixed capital, investments are made in real capital (capital-forming investments or investments in non-financial assets). Investments in money-capital are funds that in the future will be invested in the country’s real capital

The main importance of the country’s banks in turning savings into investments. The intermediary function of commercial banks is important for the economy to develop successfully. Due to their activities, the degree of risk and uncertainty in the economic system is reduced — they accumulate free cash and turn them into a strong investment resource.

One of the first methods of raising additional funds is savings deposits accepted by banks at interest. At that time, banks are performing a socially significant function — stimulating credit intermediation. This happens due to redistribution of funds of legal entities, as well as monetary incomes of individuals.

In economic theory, another relationship was supposed between the reliability of investments and the return from them. In the representations of the population — it is beneficial that it is reliable. Reliability is assumed while saving money. The first two places on profitability and reliability are occupied by tangible assets. It’s gold with the rest of the jewels, real estate. In third place are savings deposits. However, most of the accumulated funds are not invested in securities or real estate, they are not invested in a bank — on the contrary, they remain on deposit accounts or at home in rubles.

Only less than 3% of people who have savings, invest money in business or buy securities or real estate. The reason for this is not the lack of financial resources, but the fact that the majority (57%) of all people, despite the fact that they have savings or not, are convinced that the money is most conveniently stored in cash in rubles. Only about 2% of respondents are ready to invest their money in securities and about the same — in real estate

For most consumers, banking services are a forced, but not a meaningful solution. Now credit organizations are trusted by 65% of Russian citizens. The population trusts cash more than cashless payments, especially this occurs against the background of information about embezzlement of non-cash funds. In order for the population to believe in the security of non-cash settlements, much more needs to be done. 23% of the population said they do not trust electronic payment systems because they are not sure of their reliability

When the buyer receives the most popular products and services in the banking market, he faces coercion, so he has a desire not to pay for imposed additional services. In addition, most of the buyers are negative about the information that banks distribute (40% of Russian citizens are annoyed by bank advertising, of which 22% noted that ads are intrusive, and 21% are misleading and deceiving).

In addition, buyers do not believe in the reliability of information on the cost of credit, which the bank reports. The reason for the fear of customers about the good faith of banks is the consumer’s reaction to bad experience in the past, when banks used the commission, did not notify the borrowers about the real cost of the loan.

But all of the above problems can be solved by such a platform Peculiom based on blocking technology.

PECULIUM is the first savings management platform to take advantage of the

blockchain technology. PECULIUM revolutionizes savings management by

deploying immutable Smart-Contracts over the Ethereum blockchain. These

smart contracts provide a trust-less way of achieving transparent, decentralized, and infallible contractual agreements.

PECULIUM offers products with varying degrees of autonomy over the asset management, which range from completely autonomous (suitable for users and investors) to highly customizable (suitable for professional traders, larger corporations, and brokers who are interested in providing customized plans for their clients). The PECULIUM platform will allow monitoring and management of crypto-assets in real time.

PECULIUM provides transparent solutions for the investment of traditional savings in cryptoassets. Using Artificial Intelligence, PECULIUM maximizes benefits from the thriving cryptocurrency markets. PECULIUM merges traditional savings and cryptocurrency markets via blockchain technology in a mutually beneficial relationship, potentially providing outstanding returns for the invested savings.

Private Sale : Start Nov 1st, 2017 — End Nov 22nd, 2017

Pre-ICO 5 hours : Start Nov 27th, 2017 12:00 am — End 05:00 pm GMT

ICO : Start Nov 28th, 2017 — End Jan 19th, 2018

Site https://peculium.io/

Twitter https://twitter.com/_Peculium

My bitcointalk account https://bitcointalk.org/index.php?action=profile;u=1229230

My ethereum address 0x29AF24D027E5A0A74427A2A4D5dDFe09803D5F93

Tidak ada komentar:

Posting Komentar