MINERVA

world's first merchant processor & Welcome to Smart Money in Ethereal blockchain

We pay transaction fee to business, we do not charge. We address the problem of crypto-curency adoption by introducing incentive payment solutions that disrupt trade to accelerate the adoption of crypto and smart contracts in the mainstream. Minerva is the world's first reverse merchant processor.

BENEFITS OF MINERVA

New cryptocurrencies are introduced almost daily and their value can grow exponentially from the start. At the same time, many were abandoned after the novelty and market of the "honeymoon period", after which soon fell out of meaningful use. Despite this newborn market's cryptocurrency features, it is clear that some of the statistical properties of the cryptocurrency market have stabilized over the years. The number of active cryptoes, the distribution of market share, and the crypto diarrhea turnover remain predictable.

By adopting a mathematical perspective, we see a neutral model of the economy of cryptocurrency. This allows one to gather insights based on clear empirical observations, regardless of the advantages and disadvantages of one crypto above the other. We have used this research to uncover the unique nature and important factors for understanding how cryptococcus provides value to end users and long-term token holders.

- What if Ripple provides a unique advantage to companies in theindustry beyond banking and other financial institutions?

- What if Bitcoin is not controlled almost exclusively byspeculation?

- What if the Ethereum mining award is submitted to a company thataccepts it as payment and is accumulated by the platform

SPECIFICATION

TECHNOLOGY

Minerva is currently the token and smart contract ERC20 system built on the Ethereal blockade. Following this standard, Minerva tokens are easily transferable between users and platforms using an ERC20 compatible wallet, and can be seamlessly integrated into the exchange.

SERVICES AND LAYER APPLICATIONS

Certain OWL tokens will be held and issued for businesses to serve as "signing bonuses" subject to the slow-time-release and distributed algorithm on a first come basis, first served at 5% of bonus vaults to the point where the vault becomes almost exhausted and 5% signing bonus is unwarranted.

This is in addition to the Minerva OWL token bonus issued to business partners via Proof-of-Transaction on a variable rate designed to ease inflation and combat the harsh swing price. With this model, OWL tokens can be exchanged for services on Minerva-approved platforms and then resold to market by respected businesses, creating additional value for money. OWL tokens can not be generated by any other method.

The fundamental income generating aspect of Minerva allows approved and integrated businesses to increase their revenues as soon as they are implemented, and gives more flexibility to the leased platforms to reward customers with discounts.

DISTRIBUTION & SUPPLY MODELS

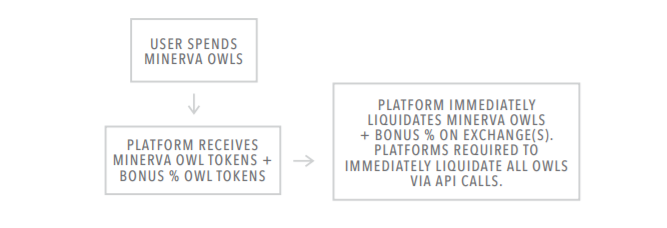

METHOD ADVANCED

Minerva uses two advanced methods to increase and decrease OWL token supplies. The first method mints a new Minerva OWL token and puts it into the economy when the partner platform receives the token as a payment method. The rate at which the current OWL token enters the economy is called the "rate of return". The reward rate is directly proportional to the OWL price: as the price increases, the rate of return rises. The reward rate will rise to increase the total supply sufficient to prevent a harsh short-run price swing. When the reward rate is greater than zero (0), a small portion of the prize is sent to the contract in which they can be exchanged for the MVP token (Minerva Benchmark Protocol tokens) and the polling token. The rate of inflation inherent rewards used to reward the platform is difficult to close by 10%.

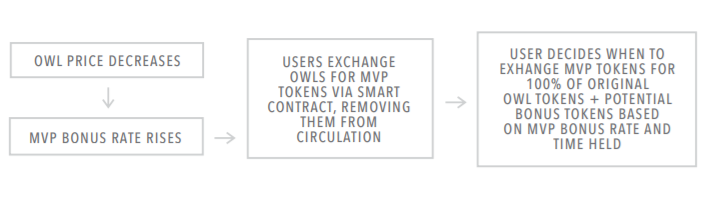

The second method sterilizes Minerva OWL tokens when the price falls. Instead of negative reward rates, we enforce systems that incentivize users to temporarily retrieve their OWL tokens from the economy. User will exchange OWL tokens for MVP tokens that represent certain OWL tokens that may (or may not) be appreciated over a specified time period. In any case the price down of the MVP token will be sold, but the more drastically the price drops at the time of purchase, the higher the potential appreciation value of this token. This MVP proof will be exchanged at a later date for the original OWL tokens paid in addition to certain additional percentages. If there is a prolonged decline where MVP-prone funds are depleted, OWL tokens should naturally regain price stability.

CUTTING SYSTEM

Voting is based on the Schelling point method inspired by Vituris Buterin's SchellingCoin, but modified to be more resistant to manipulation (described further below), to determine the approximate Minerva / USD conversion ratio. In addition to the normal transfer of OWL tokens, users will be able to use a function that enables the transfer of tokens and polls in a single transaction. Since this "piggybacking," voting will have a minimal gas cost (transaction fee). Instead of voting, voters will be given a certain number of polling tokens that are associated with their Minerva stocks that are deposited for voting.

Minerva uses four main methods to prevent voter manipulation:

- Deposits are required to choose; the deposit corresponds to the effect of the participant's vote on "Minerva contract price" and the deposit determines the prize received for voting. This deposit will be lost if the voting is considered invalid.

- A "votechain" is used in this process. Votechain allows further assessment of the validity of the past voice as new sounds are included. When a participant votes on the current price, they are also asked to enter the price of the last selected moment. These votes are then compared to previous polls and votes judged to be unlawful will lose their deposit. "Unauthorized sound" is defined as not falling between the 25th and 75th percentiles with sufficient sample sizes.

- If the votes are sufficient, all cast votes are rewarded, while at the same time only one percent is permitted to affect Minerva's contract price.

- Open source voting and polling automation with real-time log output as a failsafe mechanism. This safeguard is only activated if it is equipped with evidence of a sophisticated attack that occurs in the Minerva Volatility Protocol.

In addition to the above mentioned voter manipulation checks, Minerva uses the following methods to

avoid Minerva Volatility Protocol price manipulation:

- The time at which the new contract price begins to apply randomly so as to avoid the level of predictability that allows the manipulator to know the optimal time to buy an MVP token.

- Small fees apply when distributing the MVP token or the required hold time is set to prevent market activity that resembles speculative trading.

- The "MVP Door" applies where prices have to go down for a certain period of time before the ability to purchase an MVP token is available.

IMMEDIATE USE CASE

The first business to be integrated into the Minerva economy is a live-streaming service with revenues of $ 20MM and over 10 million users. We will show you the impact of earnings before and after a clean and concise link with Minerva. At this time, Minerva has been advised to temporarily hold the name of our first business partner. We aim to integrate a wide spectrum of major niches and mainstream businesses that cover multiple industries by recruiting platforms into the Smart Money Alliance (MSMA) Alliance.

Minerva will allow content creators to accept payments and exchange funds indiscriminately while allowing businesses to provide more value to customers and content creators alike.

PRA-SALE / CROWDSALE

BASIC INFORMATION

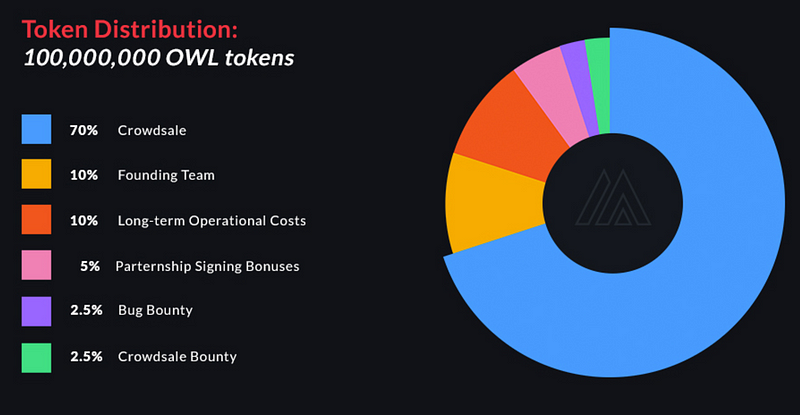

Early adopter participation takes place through a crowded dashboard accessible through Minerva.com. A total of 75,000,000 of the original 100,000,000 Minerva OWL token tokens will be distributed in two crowds. A pre-sale is followed by a major Minerva crowd, and each is accessible to parties outside the United States.

The crowd will be held in an auction format because minerva is distributed will be rewarded with the amount of donations received, and then distributed accordingly. 25.000.000 Minerva will be excluded from the crowd that is described under the "Reserve Minerva" section. After 100,000,000 initial OWL tokens are created, the creation of a new token, in addition to bonuses associated with the platform utility, will be permanently terminated. Within 1 year (365 days) of crowdsale, an announcement will be made regarding the potential exchange of 1: 1 tokens related to the proposed blockchain migration.

PRE-SALE

We will hold pre-sales tokens and will likely be held privately.

PRIMARY FINAL CROWDSALE

After the pre-sale token, the main and last crowd will take place

RESERVE MINERVA

At the end of the crowd, the founding team will receive an OWL 10% tokens allocation, depending on the holding period of twelve months (12 months). This token will serve as a long-term performance incentive for the founding team. An additional 10% will be allocated for long-term operating costs, 2.5% will be allocated to partnerships and another 2.5% for bug rewards programs. All Minerva OWL token transfers will be limited for two (2) months after the end of the crowdsale.

ROADMAP

FOUND INTERNALLY

- Basic Platform Development

- Internal Market Simulation

- Integration / Compliance Testing

- Content Translation

- List of Exchanges

- Legal advisor

- Initial Security Audit

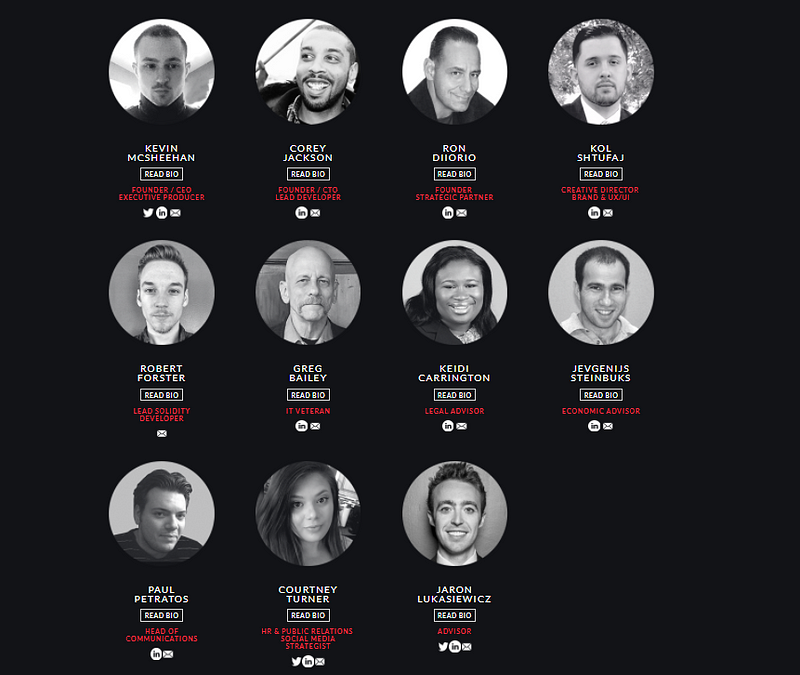

MINERVA TEAM

INFORMATION DETAILS

Website: https://minerva.com/

Whitepaper: https://minerva.com/whitepaper.pdf

Facebook: https://www.facebook.com/MinervaToken/

Twitter: https://twitter.com/minervatoken

Telegram: https://t.me/minervachat

Bitcointalk ANN THREAD: https://bitcointalk.org/index.php?topic=2072362.0

My Profile:

https://bitcointalk.org/index.php?action=profile;u=1229230

Tidak ada komentar:

Posting Komentar