HyperQuant

is a professional platform for automated crypto trading

HyperQuant is a professional platform for automated crypto trading, asset management and dApps creation that is based on the cutting-edge AI, Risk Management, Blockchain technologies and Fast Order Delivery protocol. It is made by professional quant traders who know capital management industry inside-out. All market participants from minor crypto investors to professional capital managers, VCs and hedge-funds will have access to a broad variety of intelligent solutions covering all aspects of crypto investment and crypto trading processes.

About HyperQuant

Hyper Fast

We have developed the Fast Order Delivery protocol for the platform. It works hundreds of times faster than similar solutions and provides the competitive advantage on the market. We are building relations with the exchanges, which allows us to get server colocation. That helps algorithms in our system to trade even faster.

Hyper Smart

All the components of the platform are managed by an AI that self-teaches with the accumulated data. We are also uniting the exchanges into the Electronic Communication Network (ECN), inside which the AI will be able to automatically distribute the trade deals.

Hyper Secure

The automated risk management system minimizes the risks. Trade hashes are written into the blockchain for the transparency.

Features

The whole platform works on a super-swift Fast Order Delivery protocol and is comprised of:

- ECN – the system uniting the exchanges;

- The system of AI and risk management;

- The framework for decentralized financial apps;

- Proof-of-Existence trade confirmation utilizing Parity technologies.

Technical Info

The Economy of HQ Token

Hold Tokens

- To use crypto trading bots

- To use market making and hedging software

Earn tokens

- By developing and placing on the marketplace

- By providing valuable data to the marketplace

Spend Tokens

- To create smart contract that store data about your investment portfolio and your personal configuration of trading bots

- To build your of dApps or hedge fund software on top of the platform

B2B Use Cases

Market Making: the service allowing to increase token liquidity.

Hedge-fund Software : the software allowing to start your own crypto-currency hedge-fund in a matter of minutes.

B2C Use Cases

Trading bots App: the application for trading bots management.

Telegram Bot For Trading Signals Notification: The bot sending trading signals to the users depending on their risk profile.

Intelligent telegram bot

- Sign up using your personal telegram account.

- Fill up the survey to define your risk profile

- Receive trade signals based on your risk profile

Trading-Mining software

- Start the user friendly application

- Connnect to “trans-fee mining” exchange

- Start the program! It makes buy/sell orders thus getting tokens in exchange of commission.

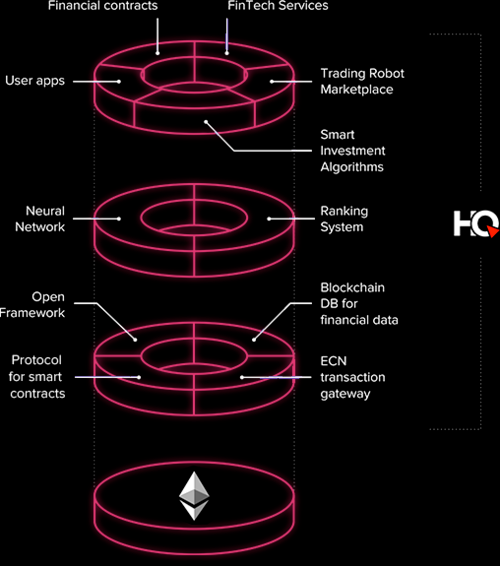

HYPERQUANT PLATFORM ARCHITECTURE

Application Layer

Providers advanced services that enhance the functionality of the platform.

AI Layer

Analyzes all elements of the platform and fully automates Data Interchange.

Core Layer

Includes all functionality for creating and deploying decentralized automated investment solutions.

Ethereum Blockchain

Provides the smart contract mechanism.

HOW DO HYPERQUANT WORK?

HyperQuant’s business model is based on an innovative approach that determines what’s important and necessary for users. The concept of this business model relies on identifying high profit zones, determining methods for gaining market share and ensuring its protection from competitors. HyperQuant ecosystem creates an architecture that makes it possible to turn pioneer technology into actual economic value. Services created in the HyperQuant ecosystem have great potential for growth.HyperQuant uses trading robots to complete trading operations on financial markets with a set of algorithms. Trading with the help of an algorithmic system has several advantages: to make decisions at maximum speed and to complete trade tasks at speeds that are not available to humans, automatically processing market data and generating trade signals, and trading signal processing accuracy allows to prevent errors by demand settings market.

Trading robots work strictly in accordance with established algorithms and complete trading operations without emotion and can manage several thousand securities simultaneously. Cryptocurrency traders and token holders are vulnerable to emotions that lead to irrational decisions. Trade strategies apply in any market, with any assets and at any time. Algorithms are carefully typed and have no risk of making the wrong decision because of uncertainty, anger, fear, and dissatisfaction. The basis of the algorithm is in the class division of strategy.

Trading strategies and models have several classifications :

Trend Following Strategy:

The main goal of this strategy is to find favorable rates for completing trading operations with the aim of maintaining a profitable position in the longest period of time. Strategies follow the trend of trying to capture the huge fluctuations of financial instruments. A trend-based strategy based on technical indicators is the most popular strategy. Technical indicators are functions based on the values of indicators of statistical exchange, for example, prices of traded instruments. The rules of opening and closing positions in this strategy are shaped by the derivation of indicators and comparative values calculated between themselves as well as the market value.

The Counter-Trend Strategy:

is a strategy based on the expectations of significant price movements and consequent positions opening in the opposite direction. The assumption is that the price will return to its average value. The counter-trend strategy is often attractive for trading because the goal is to buy at the lowest price and sell at the highest price.

Pattern Recognition Strategy:

The purpose of this strategy is to classify objects in different categories. Image recognition tasks in distributing new, recognizable objects to specific classes. Such strategies use neural networks as the basis for education and are widely used for the recognition of candlestick patterns. The candlestick pattern is a particular combination of candlesticks. There are many candlestick models and assumptions about continuous or reverse price movements happening based on the appearance of candlestick models. These assumptions are a strategy based on the introduction of technical analysis.

Arbitrage Strategy:

There are different types of Arbitrage strategies: Cross-Market Arbitrage and Statistical Arbitrage.

Strategy based on machine learning:

The basis of machine learning is the modeling of historical data and the use of models to estimate future prices. One type of machine learning is classification.

TOKEN SALE DETAILS

- Private sale: May – June, 2018

- Public pre-sale: July, 2018

- Ticker: HQT

- Token type: ERC20

- TGE Token Price: 1 HQT = 0.00028 ETH 1 ETH = 3500 HQT

- Fundraising Goal: 20 000 ETH

- Total token supply: 200 000 000 HQT

- Available for token sale: 35%

HQT TOKEN DISTRIBUTION

- Token Sale: 35%

- Reserve fund: 39%

- Team: 15%

- Advisors & Partners: 9%

- Bounty: 2%

TOKEN ECONOMY

Hold Tokens

- To use crypto trading bots

- To use market making and hedging software

Earn Tokens

- By developing and placing dApps on the marketplace

- By providing valuable data to the marketplace

Spend Tokens

- To create smart contract that store data about your investment portfolio and your personal configuration of trading bots

- To build your own trading dApps or hedge fund software on top of the platform

ROADMAP

2015 – Original Idea

1. Coming up with idea

2. Market research

3. Concept evaluation with industry experts.

4. First Experiments

2016 – Platform Blueprint & Pre-Alpha

1. Preparing Whitepaper

2. Legal Paperwork

3. Developing Trading strategies and backtesting them on real market data.

4. Building connectors to crypto trading platform.

2017 – Alpha

1.Blockchain based investment plans

2. Mobile application for bot Management

3. Hyper Token Distribution

4. Smart order routing and fast order execution protocol

5. Trading bot market-place

2018 – Open beta

1. Market Data Storage

2. Quantitative Framework with Powerful SDK

3. Market Data vendor Unified protocol

4. Visual trading bot constructor (HQ script)

2019 – B2C Solutions & AI

1. Effective execution of big trading orders

2. Risk Management & Hedging Software

3. AI Financial Advisor based on big data & neuro network

4. Investment management software for crypto hedge funds

MORE INFORMATION CLICK LINK BELLOW:

WEBSITE: https://hyperquant.net/en

WHITEPAPER: https://hyperquant.net/en/whitepaper/

TWITTER: https://twitter.com/HyperQuant_net

FACEBOOK: https://www.facebook.com/hyperquant.net/

TELEGRAM: https://t.me/hyperquant

AUTHOR: Wong linglong3

Bitcointalk Profil: https://bitcointalk.org/index.php?action=profile;u=1229230

ETH Address: 0x29AF24D027E5A0A74427A2A4D5dDFe09803D5F93

Tidak ada komentar:

Posting Komentar