Review Dexgem : Multi Chain Decentralized Protocols and and community governed launchpad.

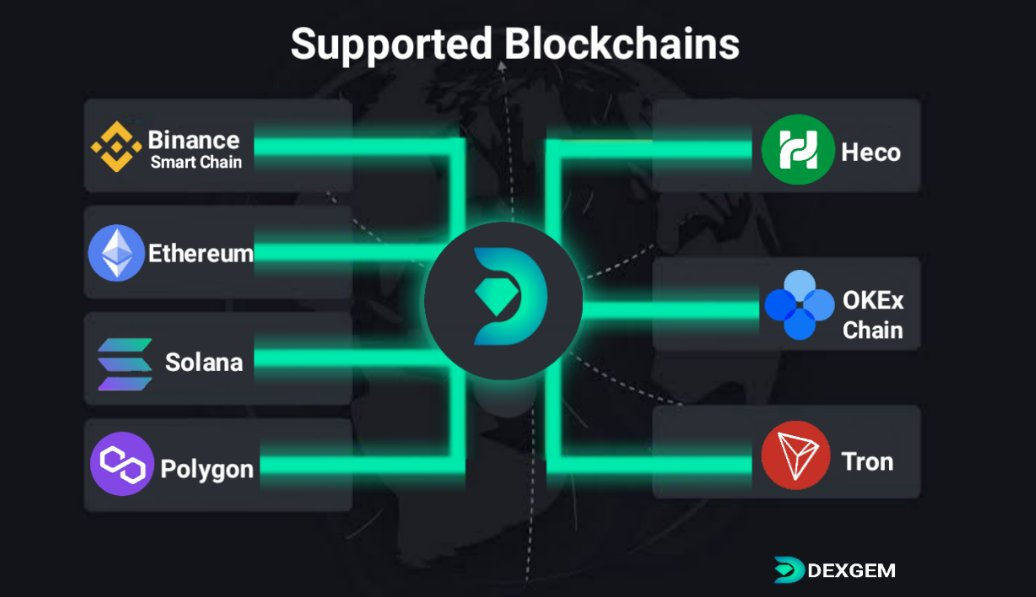

Dexgem Supported Blockchains.

Dexgem originally deployed on the Binance smart chain, our services will operational on multiple chains, allowing projects, communities and token developers to utilize the suitable tools for them. We believe the future of the entire cryptocurrency industry is multi chain..

Why choose Dexgem?

As the Binance smart chain ecosystem grows, more and more projects are expected to pop out of nowhere. For every new project that comes out, many bad actors could take advantage of the freedom and permissionless nature of DeFi to scam users of their hard-earned cash. To protect investors’ funds and save legitimate projects from inconvenient hurdles of presales, Dexgem offers a secure platform where the community is in total control of the presale process of a project.

Giving back power to the community.

Our goal is to create a secure, permissionless, and community-governed ILO ecosystem. The Dexgem token will play a vital role in this, characterized by plenty of utility. Nowadays, many launchpads exercise an overly bureaucratic and complex system to determine which project will be featured on their platform. We are different in the sense that upcoming projects can push their product to the mainstream in a more permissionless manner. Afterward, it's up to the community to decide which project will be listed for funding. A successful incubation program at Dexgem will reward projects with a token grant that will only be released after a specific time, with the community's approval, of course.

Dexgem's core features

Permissionless

Unlike countless other alternatives, Dexgem was not created to serve as the gatekeeper that controls which projects should be listed for fundraising or not. Aspiring projects are free to be listed on our platform — unhindered by red tape — as we ultimately put our faith in the community to decide what's good for the Dexgem ecosystem!

Decentralized & Community-Governed

The future of Dexgem lies in your hands; the community decides, we listen (or should we say, our smart contracts listen). Token holders will be in the position to vote for ecosystem initiatives, new platform features, and changes to Dexgem, such as the details of our guaranteed allocation model and other applications.

Liquidity Lockers

Project developers are welcomed to use our security feature allowing them to lock their liquidity provider tokens. Locking liquidity is becoming a standard in the DeFi industry, and we are proud to re-affirm this concept was brought to the market by Dexgem.

Secure Decentralized Launchpad

Dexgem ILO Platform As a token developer, our technology can serve you to launch your project. We are collaborating with an ever-increasing number of third-party providers that can review different aspects of your product. As an incubator, you can also use our technology to launch your very own incubated projects. And as an investor, feel free to browse the latest projects, read carefully the reports from external providers, and most importantly never forget your own due diligence prior to any form of participation. We highly recommend reading fully our T&Cs.

The benefits of holding $Dexgem

The idea of our multifunctional token is for you to operate in our launchpad, to stake, and to vote on governance proposals.

*Staking to receive fee distribution

A vivid and determined project like Dexgem desires a matching significance of interest and volume for their token. As a DeFi user, our farming platform will allow you to capitalize off that by getting a cut of the trading day’s token pool fees.

Staking to get Launchpad pools access

Your Dexgem tokens represent the keys to participate in our upcoming ILOs. As implied before, we have a two-round system that dictates an exclusive allocation for all — even in some of the hottest presales.

Staking for governance purposes

Dexgem holders will be in the position to vote for ecosystem initiatives, new platform features, and changes to Dexgem Exchange, such as the details of our guaranteed allocation model and other applications

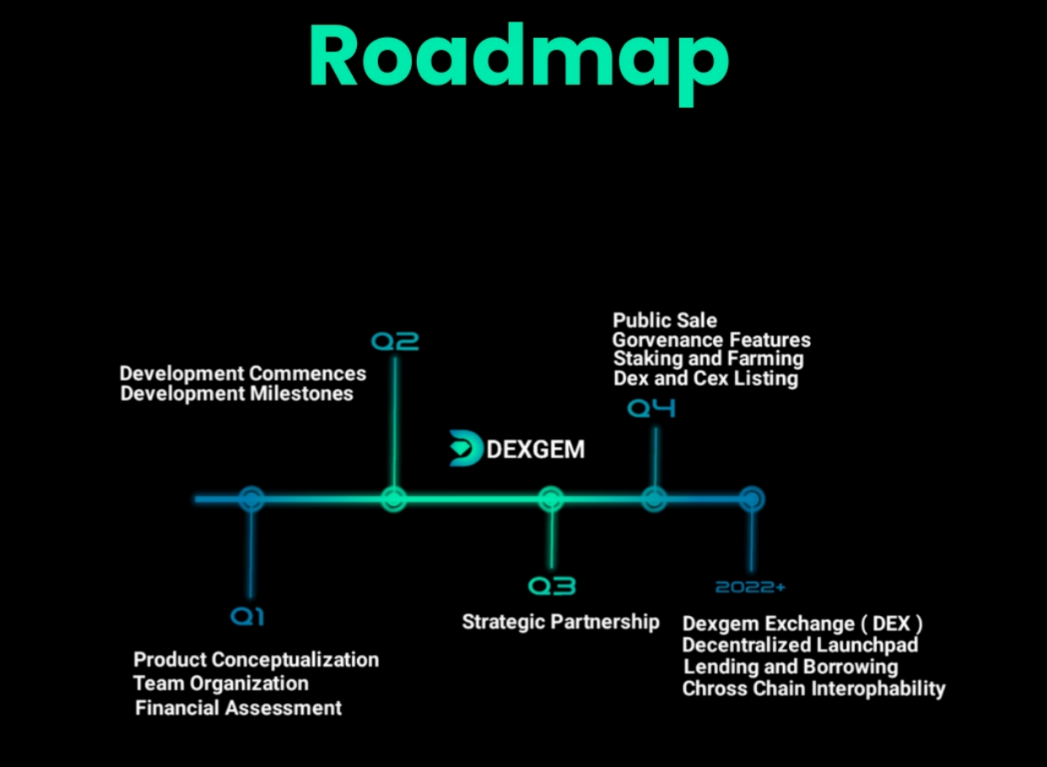

Roadmap

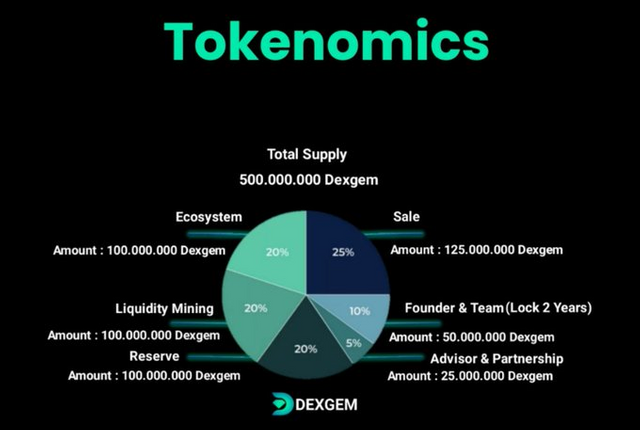

Tokenomics

Liquidity Lockers

Before explaining the concept of locking liquidity on any AMM (Automated market maker — e.g Uniswap, Pancakeswap), we recommend this video for anyone not familiar with the liquidity pools on top of Decentralised Exchanges.

What is a Liquidity Locker?

Developers that are listing their tokens on Decentralised Exchanges are granted LP tokens when they initiate a pool. These LP tokens, once in their possession, can be transferred like any other tokens on the blockchain they have been minted on (theoretically, LP tokens could also transit on other blockchains using bridges, but this is not something done very often)

A liquidity locker allows the developer to store these LP tokens in a smart contract, revoking his permission to move these LP from a start date (or, more accurately, a start block) to an end date (end block).

The Dexgem liquidity locking service is widely used when it comes to DeFi projects. We could even argue that it is an industry standard that comes right after the creation of any new liquidity pool on different Decentralised exchanges.

Join our social media

Official Website : https://dexgem.com

Whitepaper: https://dexgem.com/docs

Twitter : https://twitter.com/dexgemcom

Medium : https://dexgem.medium.com

Github : https://github.com/Dexgem

Docs : https://dexgem.gitbook.io

Author:

Forum Username: Wong linglong3

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=1229230

Telegram Username: @Wonglinglong46

BEP20 Wallet Address: 0x38064F1795F260930C0459Bf0151aDa02aDbFa45

Tidak ada komentar:

Posting Komentar